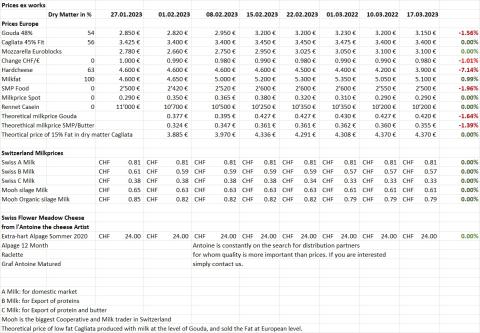

Market Report 17-3-23 Where is the long term market equilibrium for milk prices?

The 5th week with stable prices.

This stability, which we see for 5 weeks, should be positive. There are many voices and developments that give pause for thought.

I would like to quote here the article of Agrar-heute: https://www.agrarheute.com/markt/milch/milchpreise-fallen-drastisch-molkereien-senken-milchgeld-massiv-604609.

Most dairies have drastically reduced milk prices in February. In the north, the price reductions were between 3 and 10 cents, in the south it went down somewhat more moderately by 2 to 5 cents. In the west and east, prices fell by up to 6 cents. Some organic dairies also lowered their prices, albeit by a much smaller amount. Spot milk prices fell below 30 cents/kg!

The price reductions of the individual northern German dairies ranged from 3 to 10 cents per kg in February - and are likely to average around 8 cents.

Such a price slide in just one month has never been seen before. The sharpest price drop of 10 cents was reported by farmers at the Uelzen dairy. After all, 8 dairies have lowered prices by 8 cents - including Breitenburger Milchzentrale, Meierei Barmstedt, Molkerei Rücker and Nordsee Milch. Deutsche Milchkontor (DMK) cut prices by 7 cents in February. In at least 7 northern German dairies, February payout prices are below 50 cents - between 43 and 48 cents per kg.

And in Switzerland?

Milk production in January is up 1%, cheese exports are down 8%. Many cheese dairies of the large varieties Appenzeller, Emmentaler, Gruyere have reduced production.

Read our Swiss Cheese export Report 2010 - 2023 https://www.affineurwalo.ch/en/news/swiss-cheese-winning-model

Nevertheless, milk prices in Switzerland are very stable, Mooh has reduced the price by only Fr. 0.01 for March. It seems that the milk powder industry can buy and use the released milk at a high price. This is only possible thanks to appropriate subsidies. In other words, we are experiencing a structural change in Switzerland away from cheese to milk powder production.

To what extent this structural change is desired and makes sense is a question for politicians to answer. In doing so, they should not forget that Switzerland is then dependent on 2 companies that have not exactly done well in recent years.

To the question: Where is the long-term market equilibrium for the milk price?

I hope not at € 0.30 – € 0.35, but it looks like it. After the milk price rose very quickly last year, it is falling again just as quickly this year. The spot milk price is already back below € 0.30. The average price has dropped from over 0.60 to under 0.50 within 2 months, that's fas 20%. If the stock market collapses by 20%, then there is a call for the state, not so with milk. That would be like if the milk price in Switzerland would drop from Fr. 0.81 to Fr. 0.65. I think there would be quite an uproar.

This market report is published monthly, in case of unstable markets we increase the frequency.

Kind regards, Affineur Walo